Epstein His Connection to “The Club” of Manipulators

Armstrong Economics

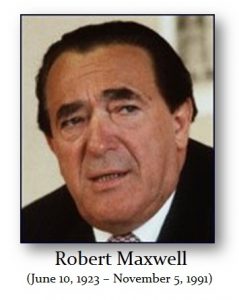

Ghislaine Maxwell was more than the alleged protector and procurer of young girls for Jeffrey Epstein as well as his girlfriend based upon allegations. However, she is also the daughter of Robert Maxwell who I believe was a member of “The Club.” Interestingly, Maxwell’s protege was also William Browder who loves to run around claiming he is the number one enemy of Putin. While the prosecutor wants to charge Ghislaine with conspiracy, nobody knows where she is. That alone in today’s world seems unbelievable. Use a credit card or turn on your phone and they have you. You need cash and a burner phone just to start. Then you need fake passports for you to book a ticket in your name and they will be there when you land waiting with open arms.

Epstein grew up in Brooklyn with no money to speak of and never finished college. She is Paris-born, Oxford-educated, a jet-setter who partied with princes and billionaires. They are reporting that Jeffrey Epstine hung himself with his bedsheet in isolation when guards were supposed to check on him every 30 minutes. The Los Angeles Times attributed any doubt to just conspiracy theories. But nobody asks the question: Why was Epstein in the hole?

You are thrown in that dungeon supposedly for disciplinary reasons. Epstein at best should have been there for a few days assuming there was no bed space in population. To be in isolation is rare since they need every bed in MCC and they will often send people to Brooklyn’s MCC when they need more space. Epstein had been in prison before so it would be no dramatic shock. To be thrown in the hole from day-one is typically on the phone call from the prosecutor. The MCC is controlled by the prosecutors when that is supposed to be illegal. But nobody will ever investigate that one. Having him in isolation without another cellmate allows for anything to happen without a witness. Who ordered to put Epstein in solitary confinement?

The fascinating connection her is Ghislaine Maxwell is the daughter of Robert Maxwell who I believe was a member of “The Club” deeply involved with Salomon Brothers and had dealings also with Goldman Sachs. You got it. The official report issued by Britain’s Department of Trade and Industrysaid investment bank Goldman Sachs Group, Inc had “substantial responsibility” for allowing Mr. Maxwell to manipulate the stock market prior to the collapse of his businesses reported the Wall Street Journal back in April 2001.

JPMorgan Chase and Deutsche Bank, which did business with Mr. Epstein, are scouring their books for clues. There also runs a conspiracy theory numbering the deaths of people associated with JPMorgan Chase, not just the Clintons. Questions still surround billionaire Les Wexner, the financier’s most prominent client prior to his first incarceration. Exactly how Mr. Epstein used Mr. Wexner’swealth to finance his own fortune is not clear. In August 2019, following Epstein’s second incarceration, Wexner addressed the Wexner Foundation by letter, delivering a detailed account of his dealings with Epstein, stating that the former financial advisor had “misappropriated vast sums of money” from Wexner and from his family. Wexner retained services of criminal defense attorney Mary Jo White of Debevoise & Plimpton, who used to be the head prosecutor in Southern District of New York. Why does he need a criminal lawyer who was the head of the New York prosecutors?

Then there is the infamous Epstein’s so-called “little black book,” of 92 pages with names, emails, and phone numbers of people Epstein knew or wanted to know, but in any event, had detailed information about. The list goes on and on includes top people from the entire financial spectrum down the food chain from Goldman Sachs to just low-level billionaires (under $2 bil).

Aside from the fact that they could NEVER allow Epstine to be put on trial with all the connections he had, there is something else beyond the sex scandal. I have explained that there is what I have called “The Club” where a number of players ban together informally to manipulate a particular market. One member will typically take the lead and take the publicity if need be. There were some hedge fund players but mostly bankers and a few big punters.

I also believe one of those in “The Club” was Robert Maxwell (1923-1991), the flamboyant billionaire British publisher, who allegedly drowned after falling off his yacht in the Canary Islands near the northwest coast of Africa. Maxwell’s last words in communication were on November 5, 1991.

Robert Maxwell is Ghislaine Maxwell’s father. The scandal unfolding was the manipulation of the US Treasury auctions back then. Note the date for the Salomon Brothers scandal manipulating the U.S. Treasury Auctions broke August 18, 1991. It was this event that I believe changed the direction of Goldman Sachs. After that scandal where the government was going to shut down Salomon Brotherswho was the biggest bond dealer in the USA for manipulating markets, all of a sudden, people from Goldman Sachs started taking posts in government.

Robert Rubin began his career as an attorney at the firm of Cleary, Gottlieb, Steen & Hamilton in New York City which represents many banks in NYC. He joined Goldman Sachs in 1966 as an associate in the risk arbitrage department and became a general partner in 1971. Rubin then joined the management committee in 1980 along with Jon Corzine of MF Global fame. Robert Rubin then became Vice Chairman and Co-Chief Operating Officer from 1987 to 1990. Rubin then served as Co-Chairman and Co-Senior Partner along with Stephen Friedman from 1990 to 1992.

This trading atmosphere of “big swinging dicks” had not learned its lesson from the 1987 Crash. This was the culture instilled by PhiBro from the commodity side of the world. Trader Paul Mozer, who had a 12-year career at the firm coming from Morgan Stanley, allegedly submitted illegal bids for U.S. treasury securities in August of 1990, attempting to corner the market by purchasing more than the 35% share allowed per individual transaction. Yet, what he eventually plead guilty to was based on only two transactions in the five-year notes on February 21, 1991 for $6 billion, which was $2 billion more than the bank was allowed to buy. The plea did not match the events.

Other Salomon employees would later tell the NY Times they were shocked:

“This was not driven by personal gain, if this is true. There’s a game here. And it was a desire to win the game.”

Mozer’s supervisor, John Meriwether who later became a founder and a consultant for Long-Term Capital Management, a hedge fund which collapsed in 1998 forcing the Federal reserve to then bail out a hedge fund. Fed bailout of his hedge fund which had a position of nearly $100 billion. Meriwether, at the time in Salomon, claimed to have chastised Mozer for the manipulation when it came to his attention, but he did not fire Mozer raising serious questions about the trading culture overall inside Salomon Brothers.

Mozer’s supervisor, John Meriwether who later became a founder and a consultant for Long-Term Capital Management, a hedge fund which collapsed in 1998 forcing the Federal reserve to then bail out a hedge fund. Fed bailout of his hedge fund which had a position of nearly $100 billion. Meriwether, at the time in Salomon, claimed to have chastised Mozer for the manipulation when it came to his attention, but he did not fire Mozer raising serious questions about the trading culture overall inside Salomon Brothers.

Shortly before the Salomon Brothers scandal erupted, Paul W. Mozer must have been aware that the Treasury knew about the trade and there would be ramifications. Before the announcement by Salomon Brothers on August 9th, 1991, Mozer then sold about $1.7 million worth of Salomon stock, which was about 46,000 shares, confirmed by the firm. The government froze the funds for it smelled like insider trading in the real sense.

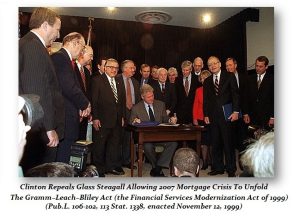

Within less than two years from the Salomon Brothers manipulation, Robert Rubin took a position in the Clinton Administration. I believe following the Salomon Brothers scandal, Goldman Sachs began to make large political donations. From January 25, 1993, to January 10, 1995, Rubin served in the White House as Assistant to the President for Economic Policy. In that capacity, he directed the National Economic Council, which Bill Clinton created after winning the presidency. Robert Rubin then became the 70th United States Secretary of the Treasury on January 11, 1995, until he managed to get Glass Stegall repealed. He left the Treasury on July 2, 1999. He was of course followed by Hank Paulson from Goldman Sachs taking the post also of Secretary of the Treasury.

There was the Robert Maxwell (1923–1991) scandal that he had stolen hundreds of millions of pounds from his own companies’ pension funds to save the companies from bankruptcy. However, behind the scenes, there may have been trading losses with “The Club” and again if there had been a trial concerning the missing $700 million+, then all other parties are exposed. A swim in the Atlantic would certainly prevent that from happening.

Maxwell’s investment bankers included Salomon Brothers, confirmed by the NY Times. Eventually, the pension funds were replenished with monies from investment banks Shearson Lehman and Goldman Sachs, as well as the British government. There were complaints before Maxwell died about dealings between his other public company, Maxwell Communications Corp, and Wall Street bankers Goldman Sachs according to The Guardian.

It was 1991 when William Browder went to work for British billionaire Robert Maxwell as his “investment manager”. The BBC called Maxwell “the biggest fraud in British history”. Just how deep into the investment decisions of Maxwell did Browder participate as an investment manager. Interestingly, after Maxwell died, Bill Browder went to work for the notorious Salomon Brothers. Browder was put in charge of the Russian proprietary investments desk at Salomon Brothers.

Salomon Brothers’ historical dependence on proprietary trading and the type of atmosphere of “big swinging dicks” had on bond arbitrage which almost destroyed the firm, thanks to Warren Buffettwho stepped in to run the firm and himself getting involved in the silver manipulation (see Bonfire of the Vanities movie). If Salomon had not been sold in 1997 with the merger of Travelers Group (which owned retail brokerage, Smith Barney), no doubt Salomon Brothers would have collapsed in the 1998 Long-Term Capital Management debacle created by one of their own – John Meriwether.

William Browder left Salomon Brothers and joined with Edmond Safra (1932–1999) founding Hermitage Capital Management in 1996 for the purpose of investing initial seed capital of $25 million in Russia during the period of the mass privatization after the fall of the Soviet Union. Beny Steinmetz, who is an Israeli businessman, with investments in diamond and precious metals mining among other things, was allegedly another of the original investors in Hermitage Capital Management. This was the firm Safra through Dov Schlein solicited me to invest $10 billion.

William Browder left Salomon Brothers and joined with Edmond Safra (1932–1999) founding Hermitage Capital Management in 1996 for the purpose of investing initial seed capital of $25 million in Russia during the period of the mass privatization after the fall of the Soviet Union. Beny Steinmetz, who is an Israeli businessman, with investments in diamond and precious metals mining among other things, was allegedly another of the original investors in Hermitage Capital Management. This was the firm Safra through Dov Schlein solicited me to invest $10 billion.

I believe Safra lost $1 billion in Russia during the 1998 Long-Term Capital Management crisis over Russian bonds and investments which was why he put his bank, Republic National Bank, up for sale to HSBC in 1999. Following the Russian financial crisis of 1998, Browder remained committed to Hermitage’s original mission of investing in Russia, despite significant outflows from the fund. Hermitage became a prominent shareholder in the Russian oil and gas. It was in 1999 when VSMPO-AVISMA Corporation (Russian: ВСМПО-АВИСМА) is the world’s largest titanium producer, filed a RICO lawsuit against Browder and other Avisma investors including Kenneth Dart, alleging they illegally siphoned company assets into offshore accounts and then transferred the funds to U.S. accounts at Barclays. Browder and his co-defendants settled with Avisma in 2000; they sold their Avisma shares as part of the confidential settlement agreement. VSMPO-AVISMA also operated facilities in Ukraine, England, Switzerland, Germany, and the United States. The company produced titanium, aluminum, magnesium and steel alloys and it does a great deal of business with aerospace companies around the world, such as Boeing and Airbus.

In March 2013, HSBC, a bank that serves as the trustee and manager of Hermitage Capital Management, announced that it would end the fund’s operations in Russia. The decision was taken amid two legal cases against Browder: a libel court case in London and a trial in absentia for tax evasion in Moscow. In June 2018, HSBC reached a settlement with the Russian government to pay a £17 million fine to Russian authorities for its part in alleged tax avoidance.

When I met Edmund Safra in Washington, DC at an IMF dinner he put on, he asked me why I was always fighting the trend. I commented that it was a dangerous club to join. I said I do know how to swim, obviously referring to Maxwell. Safra just smiled. Maxwell was presumed to have fallen overboard from his luxury yacht off the Canary Islands, and his body was subsequently found floating in the Atlantic Ocean. He was identified only by his family. The Spanish declined to take a dental impression and his fingerprints on file in London were too old. This prompted speculation that he was still alive, but that did not seem plausible. Maxwell was buried on the Mount of Olives in Jerusalem with great official participation. His cause of death was declared to be an accidental drowning.

Maxwell’s death triggered the collapse of his publishing empire as banks called in loans. Why would they call in loans on a major company unless they knew something was not right? Maxwell’s sons briefly struggled to keep the business together but failed as news emerged that Maxwell had stolen hundreds of millions of pounds from his own companies’ pension funds. That was not to support a lifestyle, that was punting money. The Maxwell companies applied for bankruptcy protection in 1992 with debts of £400 million – $717 million in U.K.-based company pension fund assets are missing from his empire. The DOL joins the probe to see that U.S. affiliates’ $300 million in pension assets are safe. Those funds, I believe, were used as part of the “club” and were lost. Had Maxwell survived and been charged, he may have given up everyone else in the “club” which would never be allowed. In 1995, his two sons,Kevin and Ian, along with two other former directors, went on trial for conspiracy to defraud but were unanimously acquitted by a twelve-man jury in 1996.

Maxwell’s death triggered the collapse of his publishing empire as banks called in loans. Why would they call in loans on a major company unless they knew something was not right? Maxwell’s sons briefly struggled to keep the business together but failed as news emerged that Maxwell had stolen hundreds of millions of pounds from his own companies’ pension funds. That was not to support a lifestyle, that was punting money. The Maxwell companies applied for bankruptcy protection in 1992 with debts of £400 million – $717 million in U.K.-based company pension fund assets are missing from his empire. The DOL joins the probe to see that U.S. affiliates’ $300 million in pension assets are safe. Those funds, I believe, were used as part of the “club” and were lost. Had Maxwell survived and been charged, he may have given up everyone else in the “club” which would never be allowed. In 1995, his two sons,Kevin and Ian, along with two other former directors, went on trial for conspiracy to defraud but were unanimously acquitted by a twelve-man jury in 1996.

Eventually, the pension funds were replenished with money from investment banks Shearson Lehmanand Goldman Sachs, as well as the British government. This replenishment was limited and also supported by a surplus in the printers’ fund, which was taken by the government in part payment of £100 million required to support the workers’ state pensions. The rest of the £100 million was waived. Maxwell’s theft of pension funds was therefore partly repaid from public funds. The result was that in general pensioners received about 50% of their company pension entitlement.