Maybe Superstorm Sandy really was an ~~~~~~~~~~ OMEN? ~~~~~~~~~~

The foundation for the original financial architecture and economic systems of the modern era was laid over the last two to three centuries. Much of the actual architecture and various systems were designed, engineered and constructed during a time that would be considered the Stone Age when compared to the Information Age of 2013. Herein lies the crux of the matter.

Way back in the days there were relatively few stock and bond exchanges, as well as limited currency and commodity trading. Of course, real estate investments have always been around but certainly not in the form of the Real Estate Investment Trusts, Real Estate Limited Partnerships, and Collateralized Debt Obligations that we see today.

Over the last century there has been exponential growth experienced in every single market across the globe. Equity, bond, currency, commodity, real estate, derivative to name the primaries. Each of their original trading platforms were built to accommodate a vastly different world. You could say that the foundation specs were quite minimal, especially relative to the 21st century.

By way of an analogy we all saw Superstorm Sandy blow through the Northeast in October of 2012. As it wended its way though New York City, what was revealed was just how vulnerable the Big Apple really is. Especially the business district in Lower Manhattan. Even the subway lines from Wall Street down to the Battery were incapacitated for an unheard of amount of time. Much of Wall Street all the way to Battery Park was either without power or completely shut down for days after the storm.

What’s the point?

The city of New York was also built over a few centuries. However, much of the infrastructure was built over the past one hundred years. Each decade of expansion brought with it new layers of technology and building materials and design changes.

As each new phase of construction was overlaid on top of the preceding one, the infrastructure has become burdened by the outdated and obsolete technology from previous times. Equipment and machinery that was old and worn out became easily stressed when forced to operate under extraordinary pressures such as weather events like Superstorm Sandy. Likewise, inferior parts and substandard components served to further weaken the entire system, especially the older infrastructure and creaking architecture, just as we saw happen in the wake of Sandy.

The following statement concerning technospheric breakdown accurately describes not only the predicament of NYC infrastructure, it’s also applicable to the current state of the global economic foundation and financial architecture.

“Equipment, machinery and technology which has not been proportionately upgraded to meet obvious requirements, ever-growing needs, newly emerging challenges and contingencies of the 21st century will begin to fail and breakdown at an ever-increasing rate.”

— “Technospheric Breakdown: Ongoing, Ubiquitous and Unstoppable“

When the economic foundation cracks and the financial architecture teeters

Herein lies the greatest challenge of the 21st century regarding the consequences of globalization and current state of worldwide banking and commerce. The world is now one huge marketplace. However, the current global marketplace was assembled over decades (and centuries) by the piecing together of a multitude of little markets. A veritable hodgepodge of financial patchwork and economic mishmash has been somehow jumbled together to make it all stick together to function as a cohesive global economy.

How the markets (read global marketplace) continues to function, given all of the obvious flaws and inherent weaknesses is anybody’s guess. Truly, only by the daily manipulations and monthly machinations of the Hidden Hand does it really continue to present some semblance of order and efficiency. Were it not for the artificially propping up of so many collapsing platforms, the whole House of Cards would have fallen many years ago. The following quote sums up the true state of affairs quite well.

“The global money matrix, worldwide financial architecture and planetary economic landscape most closely resemble the proverbial House of Cards in the form of a Pyramid-Ponzi scheme superstructure built on quicksand.”

— “The FOUR HORSEMEN Herald the Death Knell of ‘Free Market’ Capitalism“

US Government Shutdown, Debt Ceiling, and Budget Debate

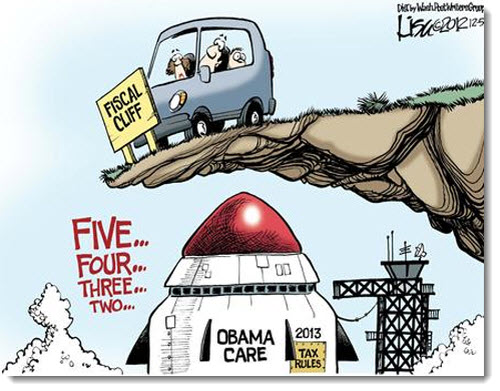

Clearly Obamacare has served as a worthy pretext to initiate the much more serious issues facing the US Government and American people. Whereas it has the potential to bankrupt the nation over the long term, so does the failure to reign in the burgeoning $17 trillion dollar debt and ballooning federal budget deficits.

In this regard, Oct. 17 functions merely as the latest in a long series of wakeup calls. Managing the largest economy on earth with virtually no budgetary consensus or attention to a catastrophic national debt level is a recipe for disaster. Overlaying the most costly and forced piece of legislation (aka Obamacare) ever, during this time of unparalleled economic turmoil and financial uncertainty, has only further pushed the USA to the brink of fiscal collapse.

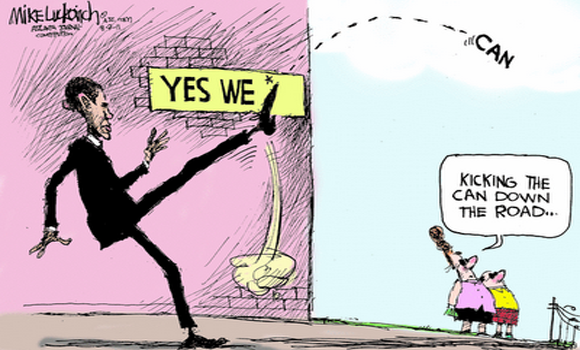

No, the proverbial CAN can no longer be kicked down the road. And to continue to do so will only make matters much worse. The various market bubbles, which are expanding against all odds at this very moment, will deflate sooner or later. If they pop in a disorderly fashion, it will not be a pretty picture.

There’s no question that the derivative market provides the glue, tape and staples which hold the entire House of Cards together. The myriad bets being placed and hedge positions being held are literally keeping this global Ponzi scheme from falling apart. Therefore, it’s imperative that serious regulatory controls be enacted on this ever-burgeoning derivative market. Otherwise, the consequences will be too great to even consider putting “Humpty Dumpty back together again”.

“Here again, demolition by derivatives will prove to be the surest way to bring down virtually every corner, of every floor, of every building, of every financial institution on planet Earth. The derivative casino will go down in history as the most pervasive, unregulated and ‘successful’ gambling establishment of all time. It broke the bank (the FED, the Bank of England, among numerous other central banks), busted up the ‘street’ (Wall Street, cobblestones of the City of London, among other national financial districts) and wreaked havoc within the US & UK governments, among many others throughout Europe, the Pacific Rim, etc. In time it will prove to be the primary reason why whole populations will find themselves broke, busted and disgusted. Truly, the Derivative Death Star will soon glow like a supernova for all future generations to gaze upon.”

— “The FOUR HORSEMEN Herald the Death Knell of ‘Free Market’ Capitalism“

It would be much better for every stakeholder playing this game, if the current opportunity (read government shutdown) for a reality check triggers a genuine attempt toward finding real solutions. Denial is no longer an option. The entire community of nations will fall victim to whatever financial apocalypse and/or economic armageddon awaits in the absence of a durable resolution.

If October 17th comes and goes without the President and Congress appropriately addressing the actual systemic issues related to government spending, tax reform and the national debt, the USA risks even greater calamity when things do reach the final breaking point*.

Cosmic Convergence Research Group

Submitted: October 8, 2013

cosmicconvergence2012@gmail.com

Author’s Note:

*The breaking point will surely come sooner than later.

The whole matrix — that would be the Global Economic and Financial Control Matrix — can no longer maintain a system which is becoming literally impossible to support.

• Just how long can the price of gold (and silver) be artificially suppressed? Especially when the Indians and Chinese can’t get enough of it.

• How much longer before the munis (once a very conservative investment) start to implode across the US like Detroit?

• Can the price of oil be controlled forever in the face increasing drilling and extraction costs? Most of the easy and cheap oil has been extracted.

• How many more natural disasters and manmade catastrophes can the insurance companies pay for?

• The inflation seen in the USA is just a glimpse of the hyperinflation around the corner. Quantitative easing has flooded the world with U$ dollars, and they are now washing up on our shores.

• Can the derivative market realistically sustain the $1.5 Quadrillion in volume … while growing even more by the day?

• The global real estate market, which undergirds so much leveraged investment, is still sitting on very shaky ground. How many loans and investments are still using gutted real estate as collateral? How many mortgages are still under water?

• The US national debt is far more than the ‘official’ $17 trillion. Were the truth known, the game would already be over.

• Since the level of entitlement programs like Social Security, Medicare and Medicaid has grown so much with the aging baby boomers hitting retirement, where is the funding going to come from?

• Truly the unfunded liabilities alone are enough to choke a horse. So are the are unfunded mandates at the state and local level.

• How will the nation pay for Obamacare in the long run? Especially in light of the aging Baby Boomer demographic ?! Healthcare expenditures comprise the biggest chunk of everyone’s budget and growing at an alarming pace!

Surely you get the picture by now. The raw physics underlying the whole system indicates a breakpoint of catastrophic overload. The irrefutable mathematics at the basis of all the crazy formulas and insane equations points to a rapidly approaching point of no return.

The relevant physics underlying the entire Global Economic and Financial Control Matrix (GEFCM) now indicates a soon-to-arrive breakpoint due to an overwhelming system overload. The irrefutable mathematics at the basis of all the crazy formulas and insane equations patented by the GEFCM likewise points to a rapidly approaching point of no return triggered by a spontaneous systemic failure of catastrophic proportions.

All the most accurate models demonstrate the same inevitable sequence of events: A stock market crash followed by a precipitous collapse at the currency exchanges, which will then cascade into a free fall in the bond market. This time around the derivative markets will not escape exposure; in fact, when derivatives crash and burn, it will ensure that the whole House of Card will never be dealt again.

References:

‘Congress all bribed, has zero confidence in eyes of American people’ – World Bank whistleblower

Post-Sandy Fixes To NYC Subways To Cost Billions

Banks: From Bubbles & Nuclear Winters To Golden Eras

SEC Charges Goldman Sachs With Fraud in Structuring and Marketing of CDO Tied to Subprime Mortgages

Cosmic Convergence Accelerates Epochal Change On Planet Earth | Cosmic Convergence: 2012 and Beyond

A U.S. Default Seen as Catastrophe Dwarfing Lehman’s Fall

All Four Wheels Come Off The Anglo-American Juggernaut

Obamacare: Worst Law Passed in Four Decades Must Be Stopped, Says Stockman

Pingback: Global Financial Architecture and Economic Systems on Verge of Collapse | 2012: What's the 'real' truth?

Pingback: Hercolubus: The Greatest Mystery Of The Modern Era | Cosmic Convergence: 2012 and Beyond

Pingback: The Biggest Coverup in USA History | Alternative News & Commentary

Pingback: » ENDING THE MONEY PARADIGM

Pingback: 2013: The Chinese Year of the Black Water Snake | Cosmic Convergence: 2012 and Beyond

Pingback: NIBIRU: The Greatest Mystery Of The Modern Era - Nibiru

Pingback: AWESOME Earth Changes Coming The Corner | Cosmic Convergence: 2012 and Beyond